$25,000

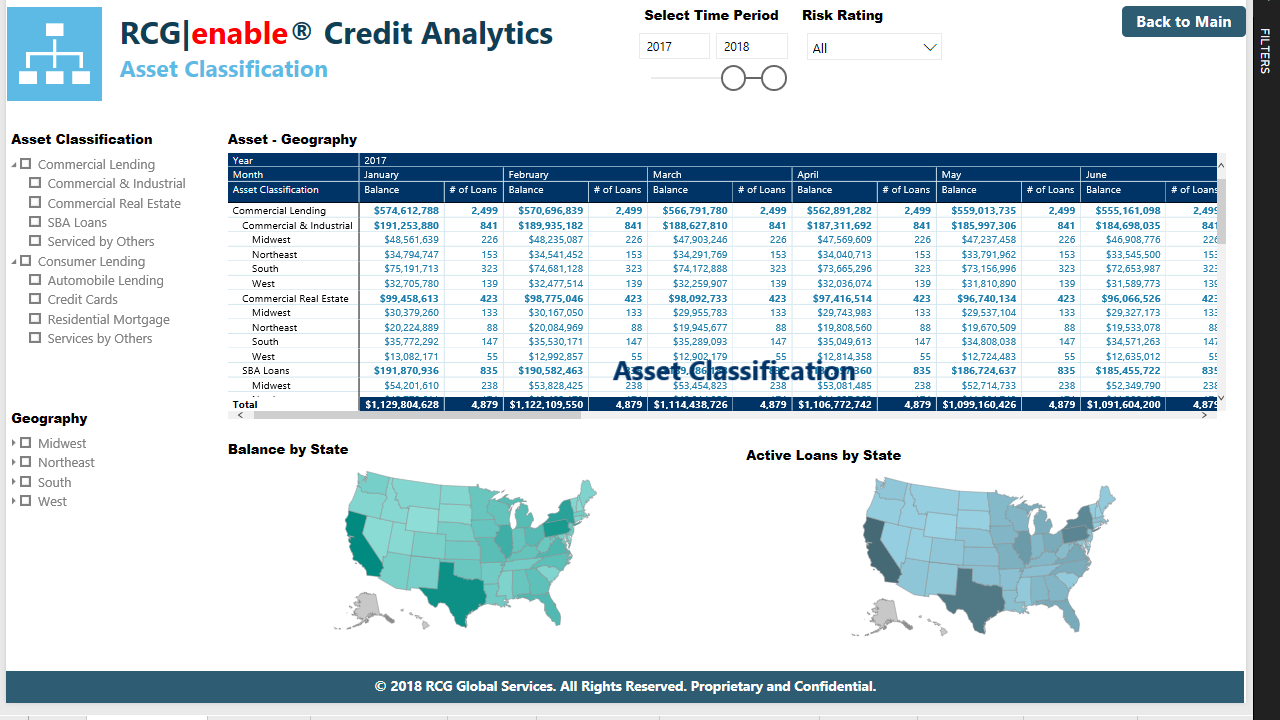

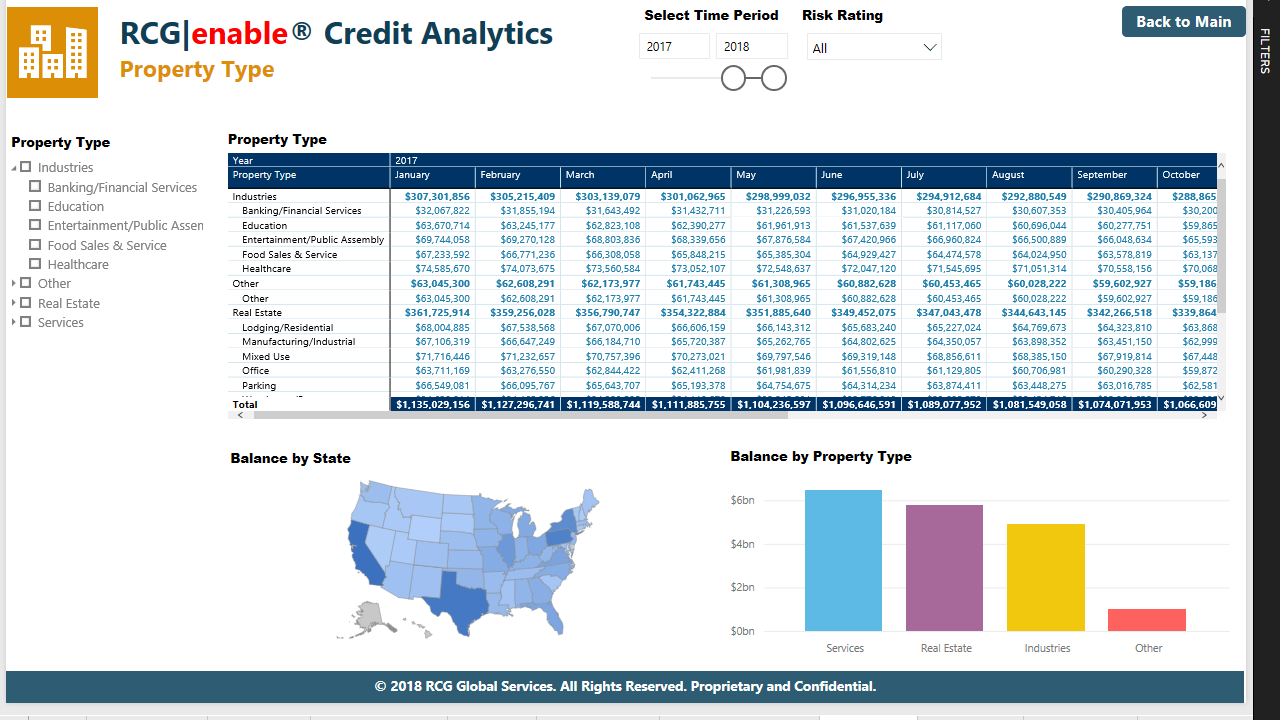

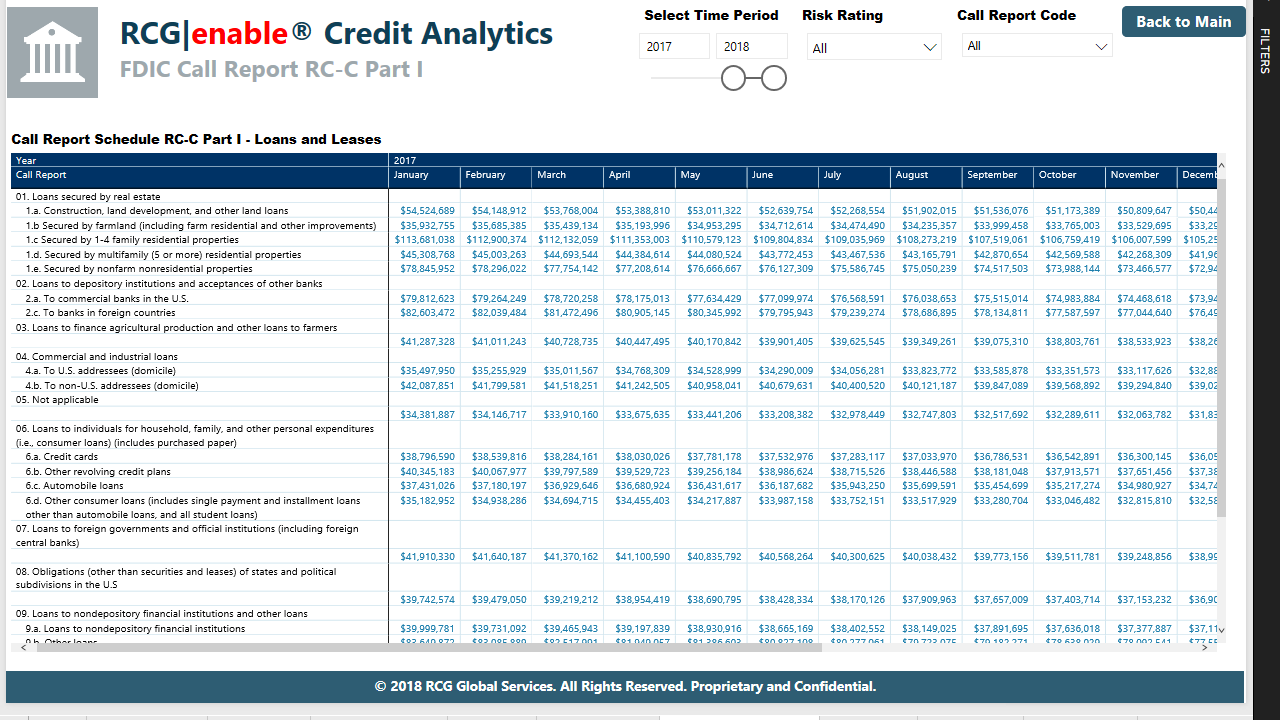

A Loan Portfolio Analytics solution used to manage risk, maximize risk-adjusted rate of return, minimize capital reserve requirements, and strengthen compliance

OVERVIEW

This 30-day trial offer allows you to use your loan data to experience RCG’s solution. It provides you the ability to assess your full loan portfolio using our secure, flexible, and expandable solution and technologies and includes quick-start support from RCG.

INDUSTRY / BUSINESS USERS

Banking / Risk or financial analysts who support a Chief Financial Officer, Chief Risk Officer, Chief Compliance Officer or Compliance Manager, or a Loan SVP or VP

USE CASES / PAIN POINTS Assessing the impact of risk exposures due to: natural events like floods, hurricanes, and tornadoes geographic, business type, and industry concentrations changing economic conditions Also, to manage: portfolio loss and capital reserve requirements FDIC RC-C Part 1 report review and submission

THE SOLUTION RCG|enable® Loan Portfolio Analytics is a solution that is ready for you to use – only your loan data is needed.

TECHNOLOGY RCG Global Services used these technologies to provide a secure, flexible, and expandable data foundation for Credit Analytics and more:

AZURE: an open, flexible, enterprise-grade cloud computing platform for clients to move faster and do more;

CAZENA: provides a secure and automated Cloudera environment that is SOC 2 compliant with end-to-end data encryption and automated maintenance;

CLOUDERA: a software platform for data, machine learning, and analytics that supports all data types widely used in financial services;

TRIFACTA: transforms data preparation – the most time-consuming and inefficient part of any data project.

WHY RCG GLOBAL SERVICES RCG Global Services is a leading provider of world-class technology solutions for complex business initiatives with over 40 years of history in providing ser

受新冠疫情影响,远程工作、在线教育、以及娱乐需求等推动,全球 PC 取得了较大幅度增长。

基于 IDC 的数据,Apple 取得了 38.9% 的年度同比增长。以 PC 这么成熟的赛道来说、这个增长相当罕见了。

MIT 的一项关于 AI 应用的调研,关于任务分配时,哪些受访者倾向于让 AI 做,哪些请i吸纳高于给初级员工(同事)做 ?

写邮件、归纳摘要、基础分析等,70% 受访者倾向于找 AI 工具,而复杂的 “项目” 类(持续几个兴起的工作、客户管理等)90% 受访者都会倾向于找同事。

AI 对人类工作(尤其是白领类)的替代已经在逐步成为现实。而 AI 时代,个体如何寻求职业发展是热门话题。

有能力胜任有一定复杂度的工作,是区别 AI 的(暂时)有效手段。即便是初级员工,也应考虑这个角度。

Apple 虽然是以 PC 起家,但走向大众更多还是靠移动设备,尤其是音乐播放器 iPod 的兴起。

看过一些分析,Apple 虽然 “颠覆” 了原有音乐及唱片行业,但 Apple 音乐也并没有赚到钱,基本是平进平出。当然 Apple 赚到了 iPod 硬件的钱,这是其商业模式的设计。

附图展示了 iPod、iPhone 和 iPad 的出货量变化,其实还应该增加一个 AirPods 的数据。